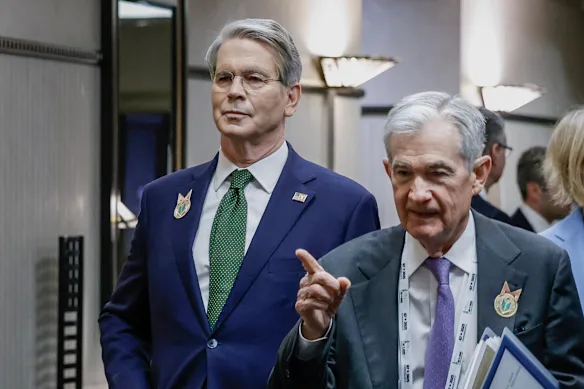

Scott Bessent is quietly rising in conversations about the Next Fed Chair

Scott Bessent the next Fed Chair, the current U.S. Treasury Secretary, has unobtrusively risen at the center of a developing discussion around who will lead the Government Save after Jerome Powell’s term closes in May 2026. According to a Jun. 10 report by Bloomberg, dialogs are underway inside and past the Trump organization around the plausibility of designating Bessent as Powell’s successor. While the White House formally expelled the report as wrong, the timing and tone of later advancements propose the thought may not be completely off the table. President Trump indicated that a choice might arrive sooner than anticipated. Scott Bessent is quietly rising

Amid open comments on June 6, he said he would title Powell’s substitution “very soon,” advertising a uncommon open flag almost a authority move still more than a year away. That comment too checked a move in tone from prior this year, when Trump over and over criticized Powell for keeping intrigued rates tall. He has contended that lifted rates are hurting financial development and interferometer with the administration’s broader goals. Scott Bessent is quietly rising

On Apr. 4, Trump recharged his feedback on Truth Social, composing that “Powell’s end cannot come quick enough.”

Federal law anticipates the president from expelling a sitting Nourished chair without cause, a point strengthened by a Incomparable Court administering in May 2025 that maintained the Fed’s regulation freedom. The choice successfully blocked any endeavor to supplant Powell some time recently his term expires. Bessent, for his portion, exhorted against such an exertion. In an meet with Politico on April 17, he cautioned that expelling Powell early may trigger budgetary flimsiness and weaken worldwide certainty in U.S. financial governance. Scott Bessent is quietly rising

How is the Nourished Chair appointed?

The Bolstered Chair is assigned by the President of the U.S. and must be affirmed by the Senate. The position carries a four-year term, in spite of the fact that reappointments are common, and chairs frequently serve over different administrations. While the Fedis organized to work freely of political weight, the assignment prepare remains political in nature, particularly amid periods of financial instability or administration transition. Powell’s current term closes in May 2026, giving the Trump organization more than a year to assess potential successors. Indeed so, early signals around the heading of the designation can impact advertise behavior well in progress of any formal decision. Scott Bessent is quietly rising. Scott Bessent is quietly rising

Analysts and worldwide money related educate track these advancements closely. Shifts in authority at the Bolstered regularly coincide with changes in financial arrangement, intrigued rate methodology, and monetary regulation. The part of the Chair amplifies past setting intrigued rates. It moreover incorporates overseeing swelling desires, guaranteeing money related framework solidness, and communicating approach course to residential and worldwide audiences. For financial specialists, clarity around the following chosen one, and the approach logic they are likely to bring, can impact certainty levels and capital allotment choices over both conventional and crypto markets.

Scott Bessent Bolstered Chair conversation picks up force, but rivals like Kevin Warsh loom

Bessent’s monetary foundation, counting time went through as Soros Support Management’s chief speculation officer, has included to his validity among Republican financial advisors. Other figures coasted incorporate Kevin Hassett, who leads the White House’s National Financial Board, Encouraged Senator Christopher Waller, and previous World Bank President David Malpass.

Each brings a diverse profile, but all are seen as possibly more adjusted with Trump’s financial approach. What makes the circumstance striking is not fair who the following Bolstered chair might be, but how early the talk has started. While Bessent has not freely affirmed intrigued in the part, his vicinity to decision-makers and his developing impact on Trump’s financial motivation are sufficient to keep the discussion going.

Decoding the Scott Bessent crypto calculus

If Bessent is inevitably assigned to lead the Nourished, the suggestions would likely go well past intrigued rate choices. His record as Treasury Secretary as of now offers early signals almost how he might approach money related leadership. Since taking office in early 2025, Bessent has been a key figure in executing the financial side of President Trump’s approach plan. He has worked to support monetary showcase certainty whereas backing a blend of charge decreases and taxes pointed at rebuilding worldwide exchange relationships.He has too been specifically included in U.S.-China exchange arrangements, a prepare that proceeds to impact instability and chance assumption. Both components tend to spill over into crypto markets, where shifts in geopolitical or cash viewpoints frequently influence request for decentralized choices like

While he has not taken a formal position on crypto control, a few reports have depicted him as “pro-Bitcoin,” citing his openness to counting advanced resources inside broader financial strategy.In a comment on Jun. The president will choose who’s best for the economy and the American people.” Such a position would likely advantage values and chance resources, counting crypto resources, which tend to perform superior in situations where liquidity is tall and intrigued rates are low. His bolster for computerized resources appears established in progressing Trump’s broader financial methodology, or maybe than stemming from a solid individual conviction in blockchain technology.that proceed to direct capital streams into or out of advanced assets.

Experts see both solidness and chance in a potential Jerome Powell resignation

Policymakers and observers of the advertising industry have provided a wide range of responses to Bessent’s potential designation. The Founded of Universal Fund’s president and CEO, Tim Adams, cited Bessent’s standing in the global financial community as a reason to seriously consider his candidacy. The former White House strategist and close advisor to President Trump, Steve Bannon, spoke with more sincerity.

In the midst of a volatile start to 2025, he praised Bessent’s arrangement administration and portrayed him as steadfast to Trump’s cause and trustworthy to markets. Bannon stated, “He’s not fair the cabinet star, but a secure match of hands for global capital markets.” Concerns about organization and common sense have been raised by others. Laffer, a financial analyst, acknowledged Bessent’s qualities but discussed the fit. He is exceptional, but he currently has a job. Laffer added, “And his claim to fame is not financial policy.” Legislators who are concerned about safeguarding the freedom of the Fed have also voiced criticism.

Scott Bessent is quietly rising

On the Senate floor in November 2024, Representative Elizabeth Warren warned that political obstacles in the central bank appear to dissolve financial specialist certainty. She stated, “It would be a genuine mistake for the Trump organization to meddled with the Fed’s independence,” noting that including a supporter in the role might cause anxiety rather than tranquility. Ed Yardeni, an expert in the market, expressed similar concerns. He cited Bessent’s previous references to a “shadow Bolstered chair” show as upsetting during a meeting with Barron’s. Yardeni argued that the presence of double authority could indeed tamper with markets, stating that it would “create a parcel of commotion in the market” and increase the likelihood of financial specialist anxiety. The behavior of the market has genuinely reacted quickly to signals regarding encouraged administration. @bitscoins.site